Legislation Underway to Repeal Truck Excise Tax

Overview

Welcome to the Law Office of Stanley E. Robison, Jr., your trusted resource for all legal matters related to the trucking industry. In this article, we will discuss the current legislation underway to repeal the truck excise tax and its potential implications for trucking companies across the nation.

Understanding the Truck Excise Tax

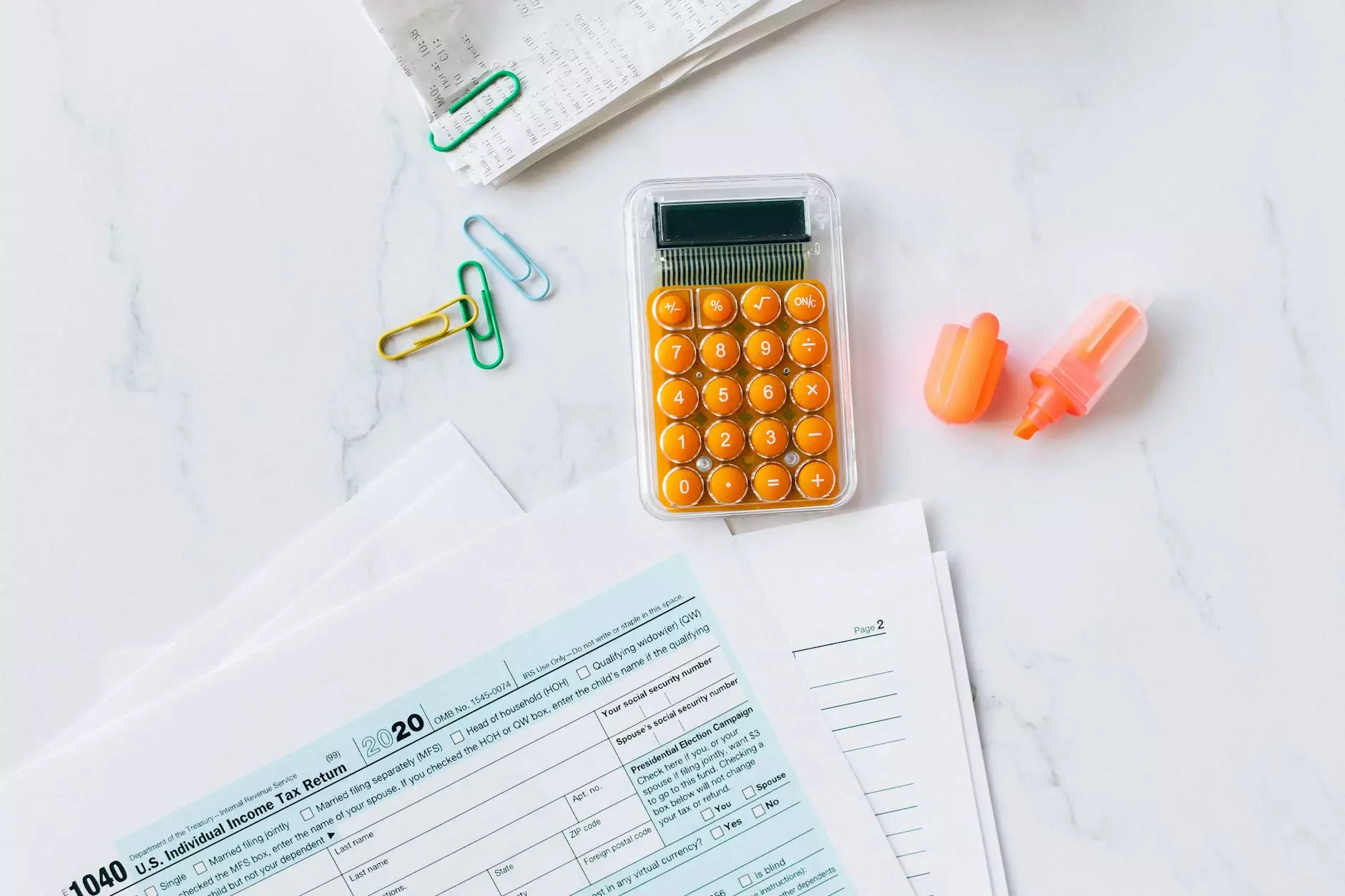

The truck excise tax, also known as the federal heavy vehicle use tax, is a tax imposed on trucks with a gross weight of 55,000 pounds or more. It is an annual tax obligation for truck owners and is typically filed using Form 2290 with the Internal Revenue Service (IRS).

While the tax revenue generated from the truck excise tax contributes to funding highway infrastructure projects and maintenance, it has been a subject of longstanding debate among industry stakeholders. Proponents argue that the tax ensures trucking companies contribute to maintaining the roads they use, while opponents claim that it adds an unnecessary financial burden on an already heavily regulated industry.

The Proposed Legislation

Currently, there is legislation underway in Congress to repeal the truck excise tax. The bill, titled "The Truck Excise Tax Repeal Act," aims to eliminate the tax burden on trucking companies and provide financial relief in an effort to stimulate economic growth within the industry.

If this legislation passes, it will have significant implications for both trucking companies and the overall economy. Trucking businesses will benefit from reduced operating costs, allowing for potential expansion, job creation, and increased competitiveness within the industry. Moreover, the potential savings could trickle down to consumers, lowering freight costs and potentially stimulating economic activity.

Potential Impact on the Trucking Industry

The potential impact of repealing the truck excise tax extends beyond immediate financial relief for trucking companies. It could lead to a shift in the industry's dynamics, prompting increased investment in fleet expansion, infrastructure improvement, and technological advancements.

Furthermore, the removal of the truck excise tax may incentivize fleet owners to replace older, less fuel-efficient trucks with newer, eco-friendly models, contributing to a greener and more sustainable trucking sector.

It is important to note that while the proposed legislation has gained support from various industry associations and lobbying groups, its ultimate outcome remains uncertain. Political dynamics, budgetary considerations, and broader policy objectives will all play a role in determining the fate of the bill.

Stay Informed with the Law Office of Stanley E. Robison, Jr.

At the Law Office of Stanley E. Robison, Jr., we understand the importance of keeping our clients informed about legislative changes that can impact their business. Our team of legal experts closely monitors developments in the trucking industry and can provide comprehensive insights into the proposed legislation to repeal the truck excise tax.

Whether you are a trucking company owner, fleet operator, or a professional driver, our experienced attorneys can help you navigate the complexities of trucking laws and regulations. We are committed to helping our clients adapt to changes in the industry while protecting their legal rights and interests.

Contact the Law Office of Stanley E. Robison, Jr. today to stay informed and receive expert legal counsel regarding the truck excise tax repeal legislation and its potential implications for your trucking business.